QuDefi: Revolutionizing Finance by Merging DeFi with Traditional Assets

QuDefi is a cutting-edge decentralized finance (DeFi) platform designed to combine the best of traditional finance and cryptocurrency. It stands out in the crowded DeFi landscape by offering regulated, AI-driven financial services and unique investment opportunities in digital and real-world assets. QuDefi was launched on the Ethereum blockchain with no pre-sales and no fundraising. QuDefi is funded by it’s founders, who have a successful track record in finance and commercial settings. Its successful stealth launch was followed by stable growth! Here’s a closer look at how QuDefi changes the game for investors.

How $QuDefi Operates

QuDefi’s primary revenue stream is leasing advanced AI-powered trading and risk management software to major financial institutions. This software, designed to emulate the decision-making processes of experienced human traders, analyzes live and historical market data to optimize trading strategies across various asset classes, including currencies, metals, and commodities.

The income generated from these leases is distributed among QuDefi token holders as rewards, providing them with a steady stream of passive income. Investors must hold at least 1,000 QDFI tokens in their wallets to participate. The platform takes daily snapshots of token balances, and ERC-20 USDT revenue rewards are distributed proportionally, with a minimum of $1 in rewards required for payout. This system is designed to be transparent and straightforward, with no complex lock-up periods or hidden terms. At the time of writing this article, over $110,000 has already been airdropped since the token launched just two short months ago.

- No Staking

- No Lockup periods

- No Complicated Liquidity Pools

- No Impermanent Loss

Building Trust and Protecting Investors with Regulation

A key feature that sets QuDefi apart from many other DeFi projects is its commitment to operating within a regulated framework. This focus on regulation is crucial for building trust and protecting investors from common risks in the crypto space, such as fraud and market manipulation. By adhering to regulatory standards, QuDefi aims to offer its users a safe and reliable environment.

Regulation also plays a pivotal role in QuDefi’s long-term strategy. The project plans to transition into a fully regulated entity, allowing it to expand its client base and offer a broader range of services, including those that integrate traditional financial systems with cryptocurrency.

To give investors even more confidence, the Board and investment team have been fully doxxed, demonstrating strong and transparent leadership.

QuDefi’s regulated Platform

QuDefi’s regulated platform offers a comprehensive suite of services to bridge the gap between traditional finance and cryptocurrency, making it accessible and secure for all users. QuDefi’s online platform is a single point of interaction from which all services will be accessible. The

framework has been structured around on-chain custody wallets using a simple process. Once an account has been funded, the client can allocate funds and assets between the on-chain wallet and virtual wallets through which all other services are accessible.

Virtual Asset Management

QuDefi is a pioneer in Virtual Asset Management, providing an all-in-one investment service that allows users to choose from different risk profiles and investment strategies. The platform is built on QuDefi’s AI Core solution, allowing crypto holders to earn yields from active trading in various assets like currencies, metals, and commodities. The process is transparent, with all asset allocations and risks clearly visible, ensuring users have full control over their investments.

Earn with QuDefi

QuDefi’s “Earn” service is a simple and secure way for investors to lend their crypto assets to QuDefi’s regulated entity in exchange for competitive returns. This service falls under the lending and borrowing category, offering flexible options for lending periods and yields tailored to meet diverse investor needs. QuDefi’s strong focus on risk management ensures that investors’ funds are protected, and investors can confidently expect to receive their initial investment back along with the agreed-upon returns.

Crypto Credit with RWAs (Real World Assets)

The Crypto Credit feature introduces an innovative way to borrow against real-world assets (RWAs) within the crypto ecosystem. QuDefi transforms assets like real estate or business contracts into digital tokens through tokenization. These tokens can then be used as collateral to secure loans in cryptocurrency. This system allows borrowers to access liquidity while retaining ownership of their valuable assets. If a borrower defaults, QuDefi’s regulated service actively enforces legal measures to recover debts, ensuring the interests of both lenders and borrowers are safeguarded.

Tokenization of RWAs

QuDefi aims to simplify asset tokenization, converting tangible assets such as real estate, art, and commodities into digital tokens on a blockchain. This process democratizes investment opportunities, making them accessible to a broader audience while enhancing market liquidity. QuDefi’s Virtual Asset Service Provider (VASP) ensures legal compliance and investor protection throughout the tokenization process, creating a secure marketplace for these digital assets. QuDefi empowers individuals to participate confidently in the global digital economy through tokenization.

By integrating these services, QuDefi offers a secure, regulated platform that enables users to seamlessly navigate the intersection of traditional finance and the crypto world, unlocking new avenues for investment and financial growth.

The QuDefi Team

The QuDefi team is fully doxxed, meaning their identities and backgrounds are publicly known, which is a significant trust-building factor in the cryptocurrency space.

CEO Duncan Dibble, a UK-based leader with 13 years of board-level experience, is leading the team and is known for his ability to drive business transformation through data and innovation. COO Ruairi Laughlin-McCann brings over a decade of experience in financial services, excelling in corporate governance and compliance. CMO Lee Davies has a strong traditional and digital asset management background, notably leading successful RWA and NFT projects.

This transparent and experienced leadership team reinforces QuDefi’s commitment to building a trustworthy and secure platform for investors.

From trending globally to reaching numerous milestones, advancing developments, and a community that keeps growing, we're gearing up for an even better month ahead!

— Qudefi (@Qudefiai) August 11, 2024

It's all happening here at #QuDeFi. 🎯$QDFI pic.twitter.com/04vvt8tehP

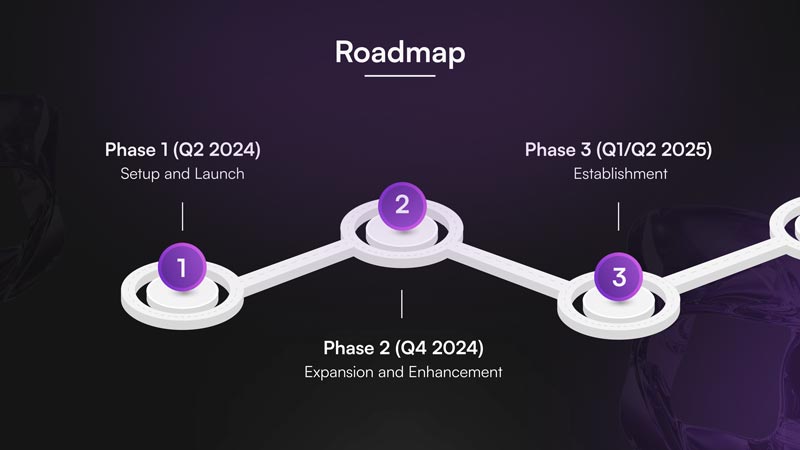

Roadmap for Future Development

QuDefi has an ambitious roadmap that outlines its plans for expansion and enhancement over the coming years. The project is currently integrating its technology with its token economy, linking revenue generated from institutional clients to the QuDefi token. This will lay the foundation for a robust revenue-sharing utility, providing additional value to token holders.

In the next phases, QuDefi aims to introduce a range of new services, including a proprietary cryptocurrency exchange, advanced custody solutions for digital assets, and borrowing and lending services that allow users to leverage their real-world holdings for crypto loans. The platform also plans to focus on tokenizing real estate and private equity, further expanding the scope of its investment offerings.

Where to Purchase $QDFI

FAQs

-

What is QuDefi, and how does it relate to Decentralized Finance (DeFi)?

QuDefi is a decentralized finance (DeFi) platform that combines traditional finance with blockchain technology, allowing users to earn revenue through cryptocurrency investments, airdrops, and token trading. By leveraging AI-driven strategies, QuDefi helps users participate in the DeFi market with ease.

-

How does QuDefi generate revenue for its users?

QuDefi generates revenue through leasing AI trading software. A portion of the revenue is distributed to token holders in USDT based on their market cap share.

-

What are Real-World Assets (RWAs), and how are they used in QuDefi?

Real-world assets (RWAs) such as real estate, art, and commodities are tokenized into ERC-20 tokens on the Ethereum blockchain. These tokens can be traded within the QuDefi ecosystem, providing liquidity and investment opportunities in crypto and traditional finance markets.

-

How can I track the price and market capitalization of QuDefi tokens?

You can track the price, USD value, and market capitalization of QuDefi tokens on cryptocurrency tracking sites like CoinMarketCap. Additionally, tokens are traded on platforms like Uniswap, Bitmart, MEXC, and more, where you can monitor their market performance and liquidity.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Cryptocurrency investments are highly speculative and come with significant risks, including the potential loss of your entire investment. Always do your own research (DYOR) before making any investment decisions. The opinions expressed here are solely those of the author and do not constitute endorsements or recommendations for any specific assets or strategies. Consult with a qualified financial advisor before investing in cryptocurrency or any other financial products.